Why Recurring Revenue Moves the Needle for U.S. SMBs in 2025

Converting first-time shoppers into long-term subscribers is no longer a Silicon Valley luxury. In a market where customer-acquisition costs have risen by more than forty percent since the pandemic, steady subscription cash flow lets U.S. retailers and SaaS founders forecast inventory, payroll, and ad spend with confidence instead of guesswork. Yet many small and mid-sized businesses still shy away, worried that setting up dunning logic, proration rules, and multi-state tax compliance will bury them in technical debt. Stripe Billing and its companion service Stripe Tax eliminate that fear by automating card lifecycle management and U.S. sales-tax remittance while giving shoppers the friction-free checkout experience they already trust on major platforms.

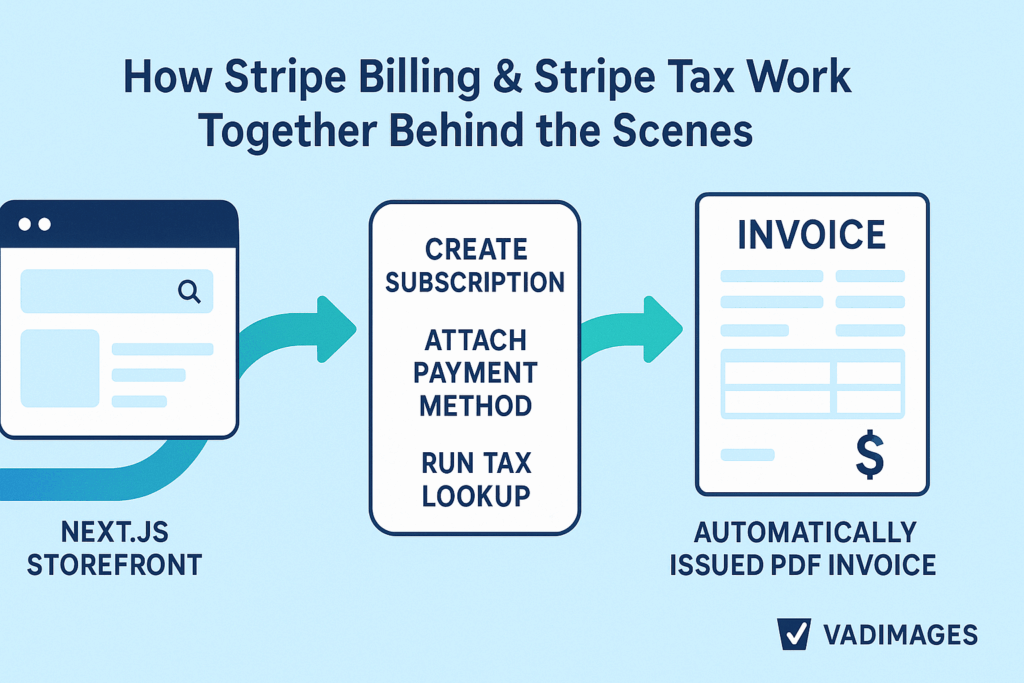

How Stripe Billing & Stripe Tax Work Together Behind the Scenes

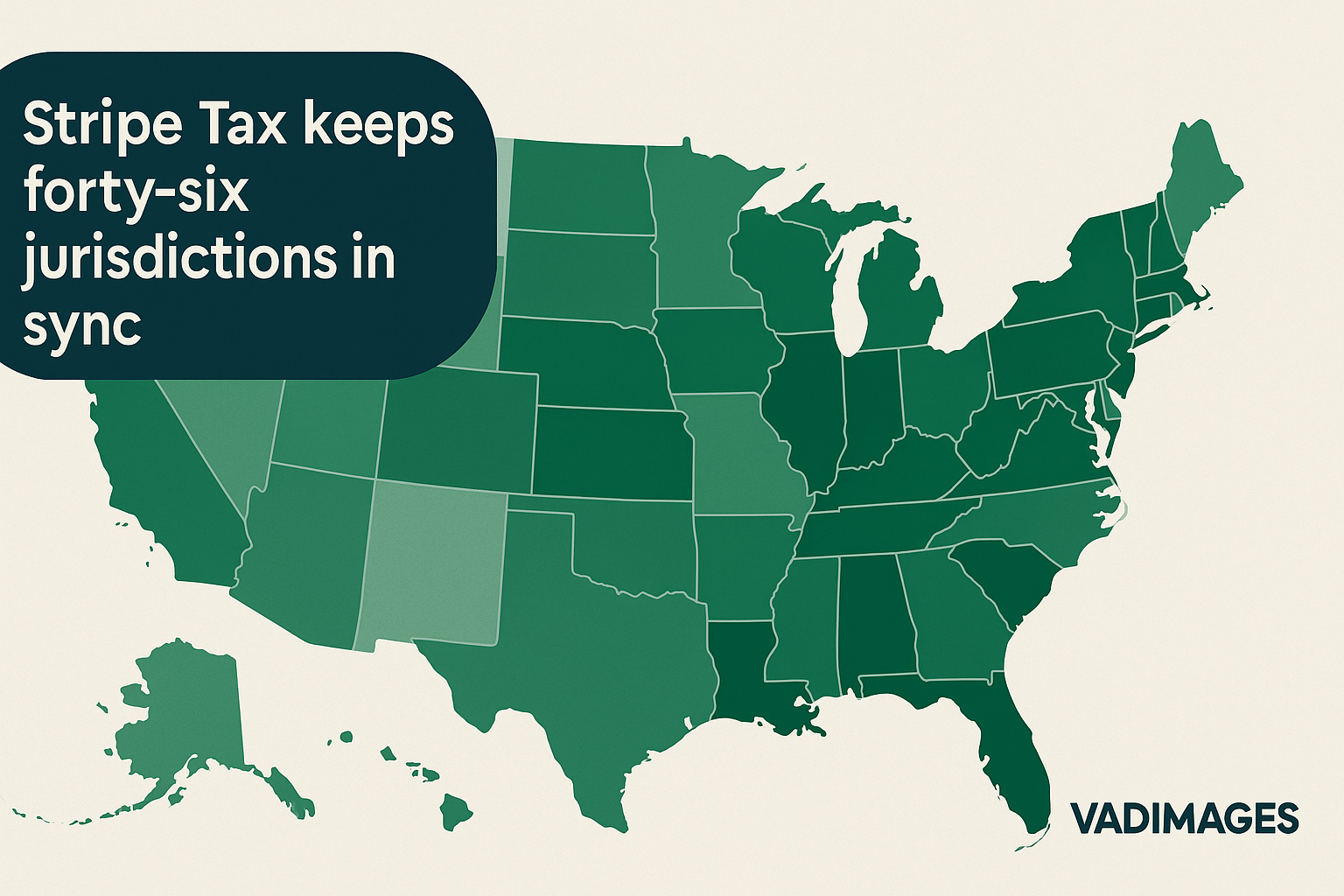

Stripe Billing extends the core Stripe Payments engine with customer objects, price catalogs, subscription schedules, and smart retries. The moment a buyer selects a plan, Stripe creates a subscription record that links product metadata to the card token stored in Stripe Vault. If the card expires next quarter, automated Lifecycle Management triggers network tokenization or sends an email update link, cutting involuntary churn by up to fifteen percent. When the invoice is generated, Stripe Tax evaluates the customer’s shipping address against up-to-date state and local thresholds, applies the correct rate, and attaches a jurisdiction ID to the line item. At the end of each filing period, downloadable reports summarize liability, ready for your accountant or for direct e-file through supported states. All of this happens via API calls as short as fourteen lines of code, leaving your engineers free to build customer-facing value instead of coping with edge-case math.

A Proven Launch Blueprint from Vadimages: Your Subscription Store Live in Four Weeks

Over the past eighteen months Vadimages has onboarded fitness apps, digital-course marketplaces, and specialty-food clubs onto Stripe Billing with a playbook honed for U.S. regulatory nuance. Week One focuses on product catalog modeling: our architects map every tier, add-on, and discount to Stripe metadata so marketing can A/B-test prices later without code deploys. Week Two delivers secure customer onboarding using Next.js Server Actions and durable Stripe webhooks hosted on edge functions for sub-50 ms response times nationwide. Week Three layers in Stripe Tax and custom renewal email templates that speak your brand’s voice, not a generic receipt. By Week Four the sandbox store graduates to production, complete with real-time dashboards that surface monthly recurring revenue and churn in a single glance. Clients typically recoup implementation costs within the first billing cycle, and Vadimages continues as a fractional CTO partner, optimizing plan mix as your subscriber base grows.

A Midwest coffee-roaster who switched from one-off Shopify checkouts to a Vadimages-engineered subscription bundle saw sixty-five percent revenue stability month-over-month and finally unlocked financing for a second roaster line because lenders valued predictable cash flow. Similar stories repeat across wellness boxes and B2B SaaS tools: once Stripe Billing handles the heavy lifting, founders redirect energy from payment fires to product innovation, marketing creativity, and support quality—exactly where smaller teams outshine slower incumbents.

Ready to Transform One-Time Buyers into Lifelong Members?

Vadimages specializes in stitching modern subscription infrastructure into existing tech stacks without ripping out what already works. Whether you run WooCommerce, a headless Shopify Hydrogen front end, or a bespoke Laravel API, our engineers integrate Stripe Billing, Stripe Tax, and advanced analytics so your finance team sleeps at night and your customers never feel a hiccup. Visit Vadimages.com/contact to schedule a free thirty-minute architecture review and receive a personalized roadmap valued at $1 500—complimentary through June 30, 2025 for new U.S. SMB engagements.

Leave a Reply

You must be logged in to post a comment.